You've seen the ads. A memory foam pillow that promises to cure neck pain. Japanese kitchen knives "handmade by third-generation bladesmiths." A spinning scrubber that makes cleaning effortless. They appear on Facebook, Instagram, YouTube—short, punchy videos demonstrating products you didn't know you needed.

Behind these ads sits Orbio World, a Lithuanian company that generated €153 million in revenue in 2024 by operating 22+ separate consumer brands. They've mastered the art of performance marketing at scale, generating 7.8 billion ad impressions annually and reaching 10 million consumers across 200 countries.

But Orbio World's story isn't just about marketing success. It's also about what happens when brilliant advertising meets commodity products and disposable brand strategy—a case study that reveals both the possibilities and limitations of white-label dropshipping at scale.

The numbers behind the operation

Orbio World emerged from the 2022 merger of digital marketing agency YNOT Media and e-commerce company Ekomlita, both founded by Andrius Valatka and Marius Buzaitis in Kaunas, Lithuania. The business model is straightforward: source generic products from Chinese factories, create compelling brand narratives, drive traffic through performance advertising, and sell direct to consumers.

Their portfolio includes brands you've likely encountered:

Derila - Memory foam pillows ($25-40)

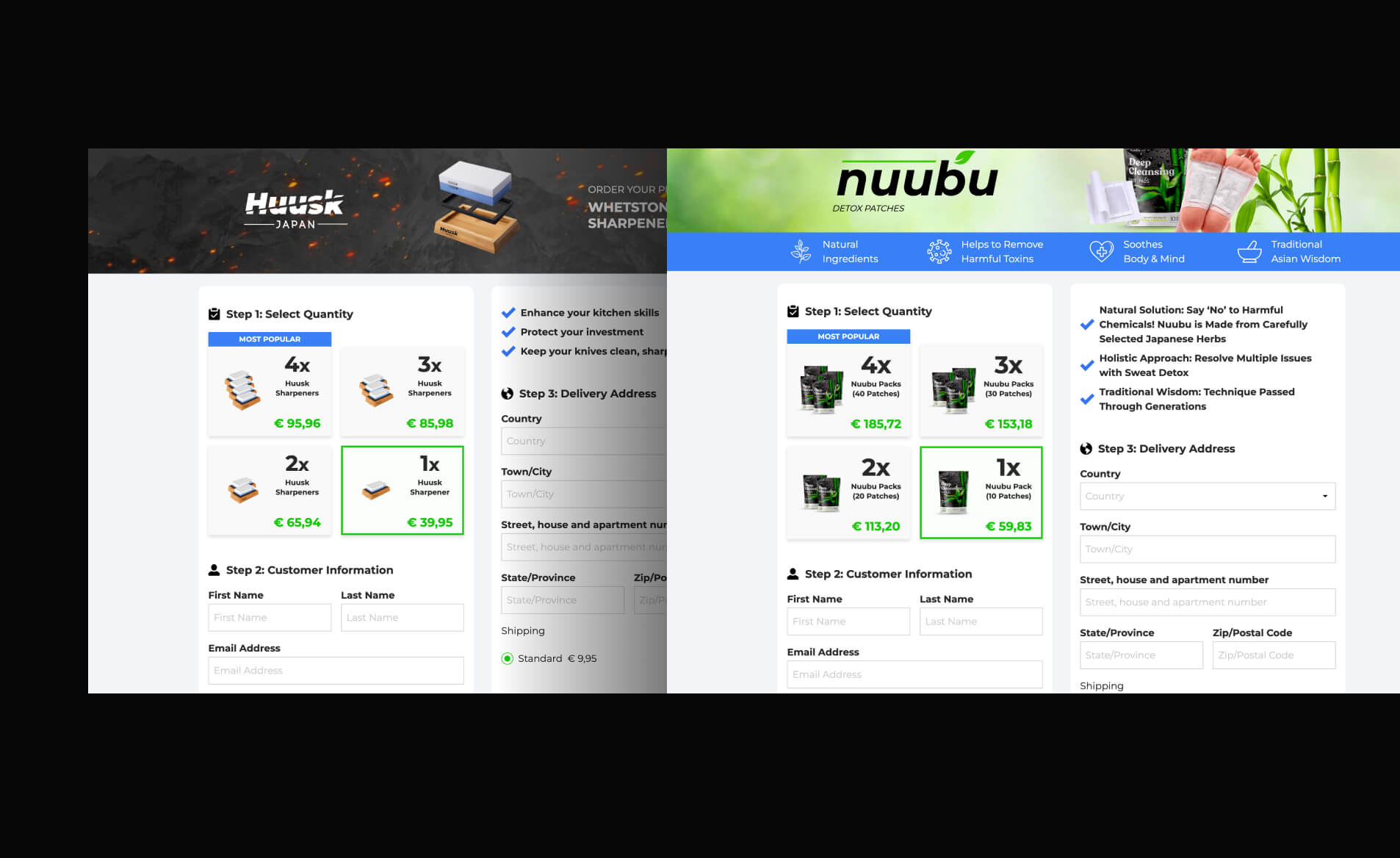

Huusk & Matsato - Kitchen knives marketed as "Japanese" ($40-60)

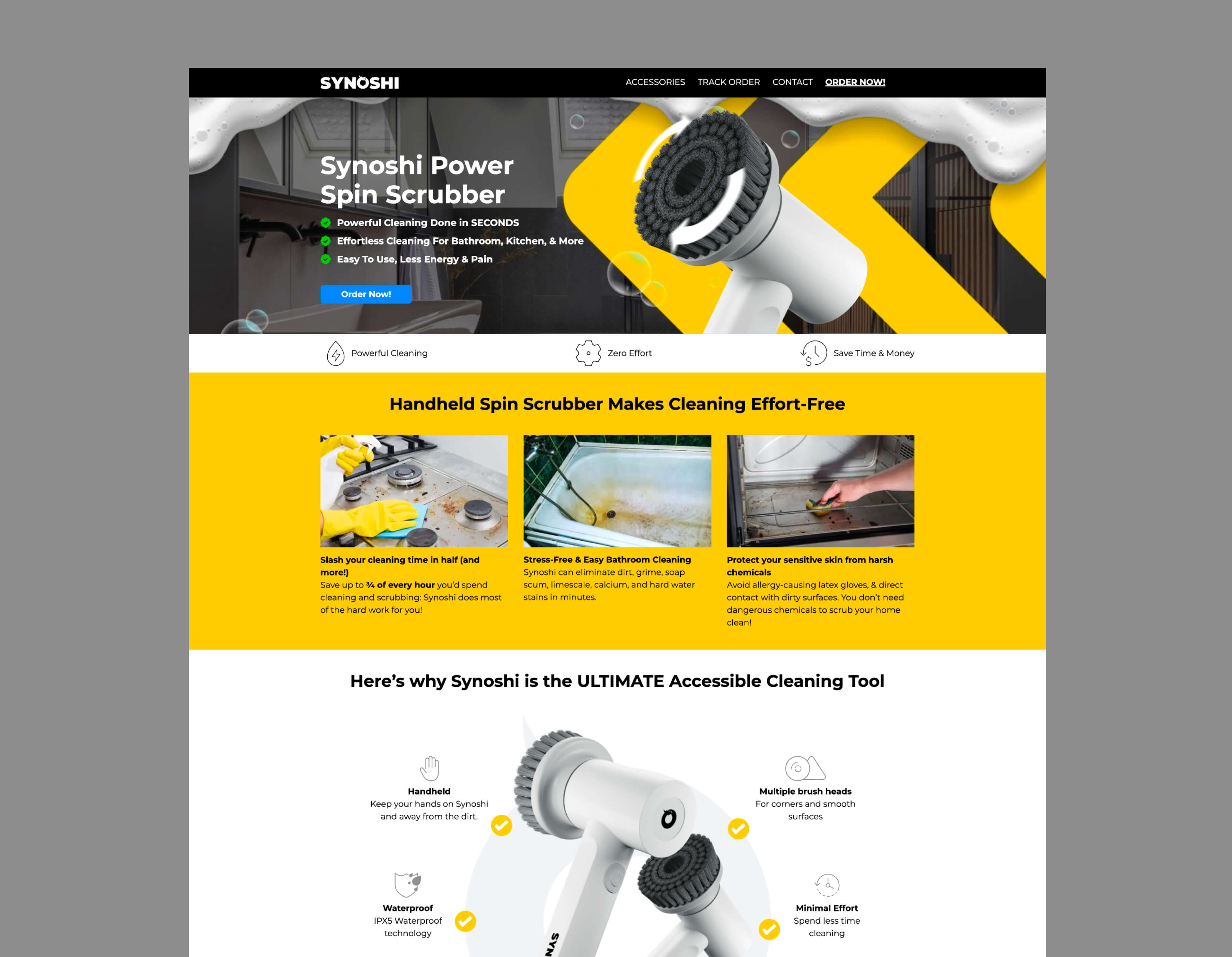

Synoshi - Electric cleaning scrubbers ($35-50)

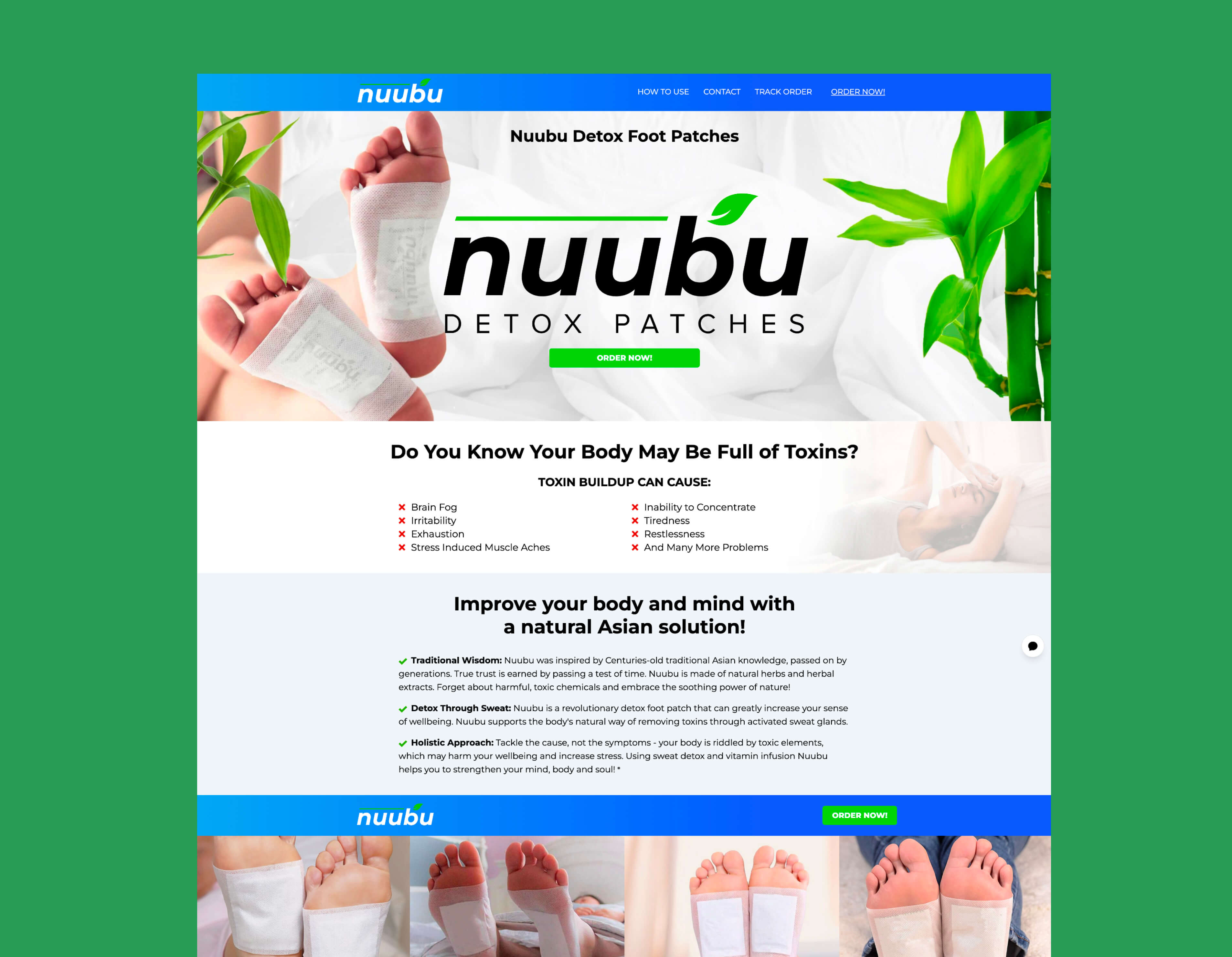

Nuubu - Detox foot patches ($30-45)

Tvidler, Klaudena, Poliglu, Enence, Haarko, Fuugu, Melzu, Ryoko - Plus approximately 14 more

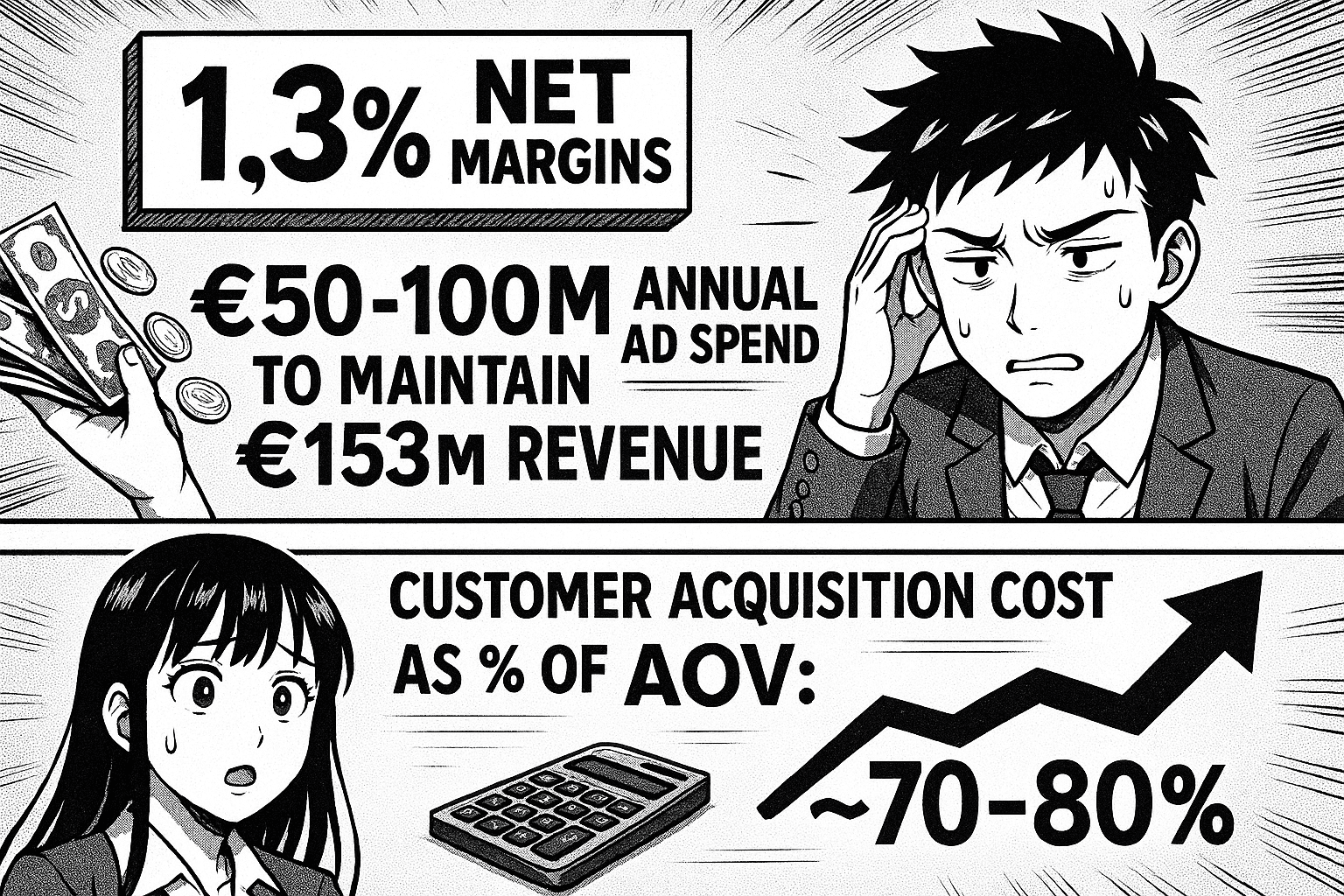

The financial reality is striking: €153.2 million in 2024 turnover with only €1.96 million gross profit—a 1.3% margin. This isn't a product business. It's a marketing arbitrage operation that happens to move physical goods.

The company employs 242-368 people (reported range varies by source) and operates through multiple subsidiaries including US entity EcomLT LLC in Tennessee. They've bootstrapped this growth without venture capital, proving the model's commercial viability through sheer execution.

The marketing machine that drives everything

Orbio World's core competency is industrial-scale direct response advertising. Their 2024 metrics tell the story:

7.8 billion ad impressions annually

136 million clicks across all campaigns

€50-100 million estimated annual ad spend (inferred from 1.3% margins)

Their acquisition channels span the entire digital advertising ecosystem:

Meta/Facebook Ads (primary driver)

TikTok Ads (growing channel with dedicated creative team)

YouTube Ads (long-form product demonstrations)

Native Advertising (Apple News, MSN, news sites)

TV Advertising (UK channels including Sky Cinema)

Affiliate Marketing (CPA programs paying $25-60 per sale)

The team structure reveals priorities: Senior Google Media Buyer, Senior Meta/TikTok Media Buyer, Creative Strategist, Conversion Copywriter, CRO Manager, and notably a "Reputation Specialist (Reddit & Community)" for damage control.

Their advertising follows classic direct-response formulas: urgency tactics, inflated anchor pricing (showing $83 "regular price" for $25 products), volume bundle discounts, and perpetual "last day" promotions that run continuously. It works—the conversion rates necessary to sustain €153M revenue prove the creative effectiveness.

Where the model breaks: product origin versus brand claims

The commercial success becomes complicated when examining the gap between marketing narratives and product reality. Independent investigations reveal systematic patterns across multiple brands:

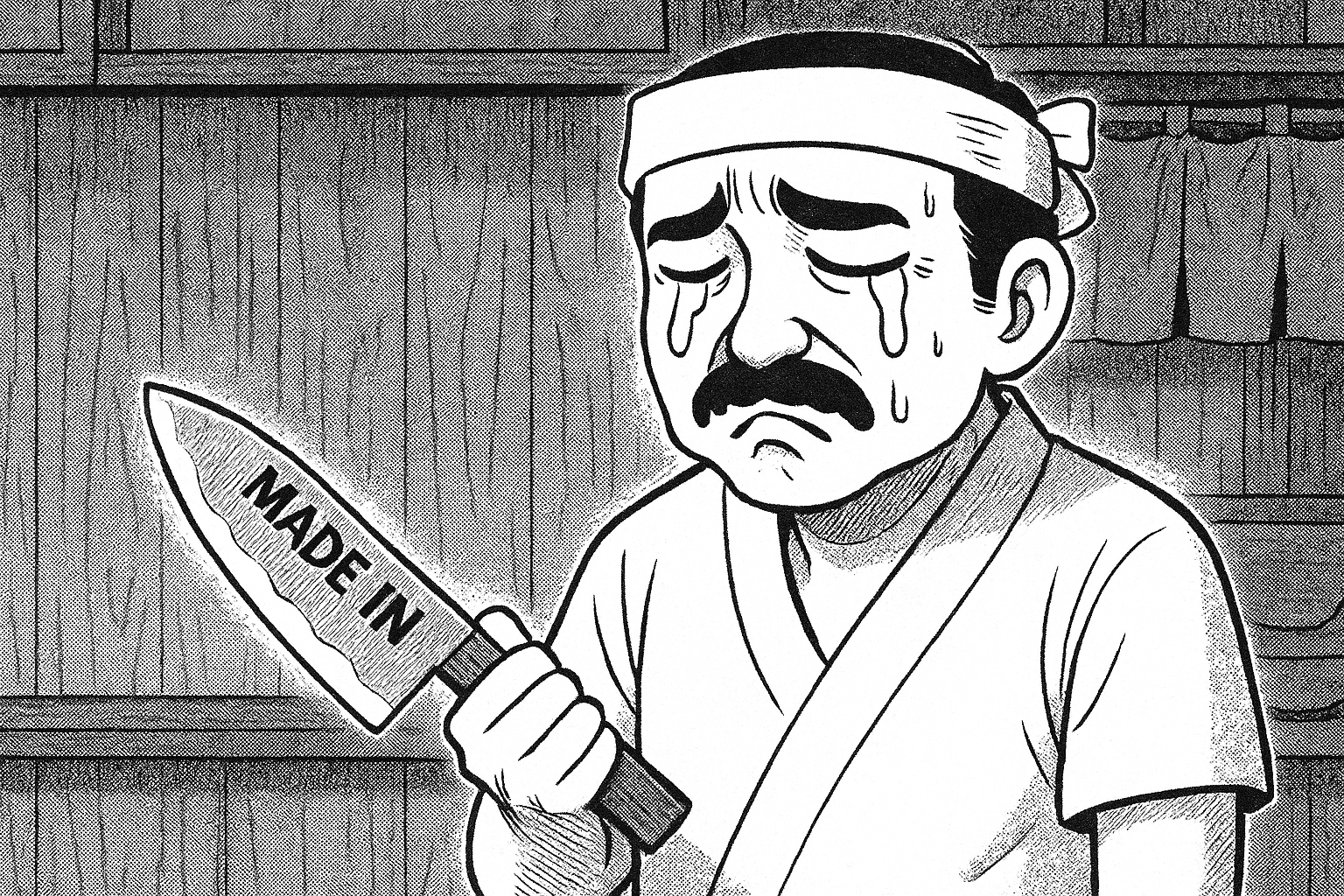

The "Japanese knife" that isn't

Both Huusk and Matsato market heavily using imagery of traditional Japanese blacksmithing. Huusk's marketing claims products are "handmade in Japan using traditional Japanese blacksmithing techniques" and "made by third-generation expert Japanese bladesmiths" requiring "138 steps and over 2 months to craft each knife."

Investigation by knife enthusiasts and consumer watchdogs reveals a different origin:

Identical knives available on AliExpress for €7-13 versus Huusk's "discounted" price of ~€35

Packaging indicates 18/10 stainless steel (standard cookware steel with 0.1% carbon content versus the 0.5%+ required for quality knife steel)

Customer photos show products marked "Made in China"

The "forged black" appearance is painted on and can be scratched off

No documented connection to Japanese manufacturing

The company is registered in Lithuania with supply chain sourced from China. The "Japanese" positioning is brand storytelling disconnected from product reality.

Memory foam that isn't memory foam

Derila pillows face similar scrutiny. Customer complaints consistently describe pillows arriving "very thin," "flat," and failing to expand properly. Independent testing by Sleep-hero.co.uk found foam that "feels firm, with barely any contouring effect" and "bounces back quickly after pressure is applied"—characteristics of low-quality polyurethane foam rather than memory foam.

The Derila pillow itself is a generic cervical memory foam pillow likely sourced for $5-8 wholesale from Chinese factories, then branded and sold for $25-40. It's functional as a basic pillow but represents significant markup over identical products available directly from original suppliers.

Analyzing Orbio World's brand portfolio: A design breakdown

To understand what works and what doesn't in Orbio World's multi-brand strategy, I evaluated five of their major brands using a branding framework focused on seven critical elements: Brand Name & Memorability, Visual Identity & Consistency, Positioning Clarity, Brand Story/Narrative, Differentiation, Trust Signals, and Brand Cohesion Across Touchpoints.

Each element is scored 1-10, with 10 being excellent execution and 1 being poor execution.

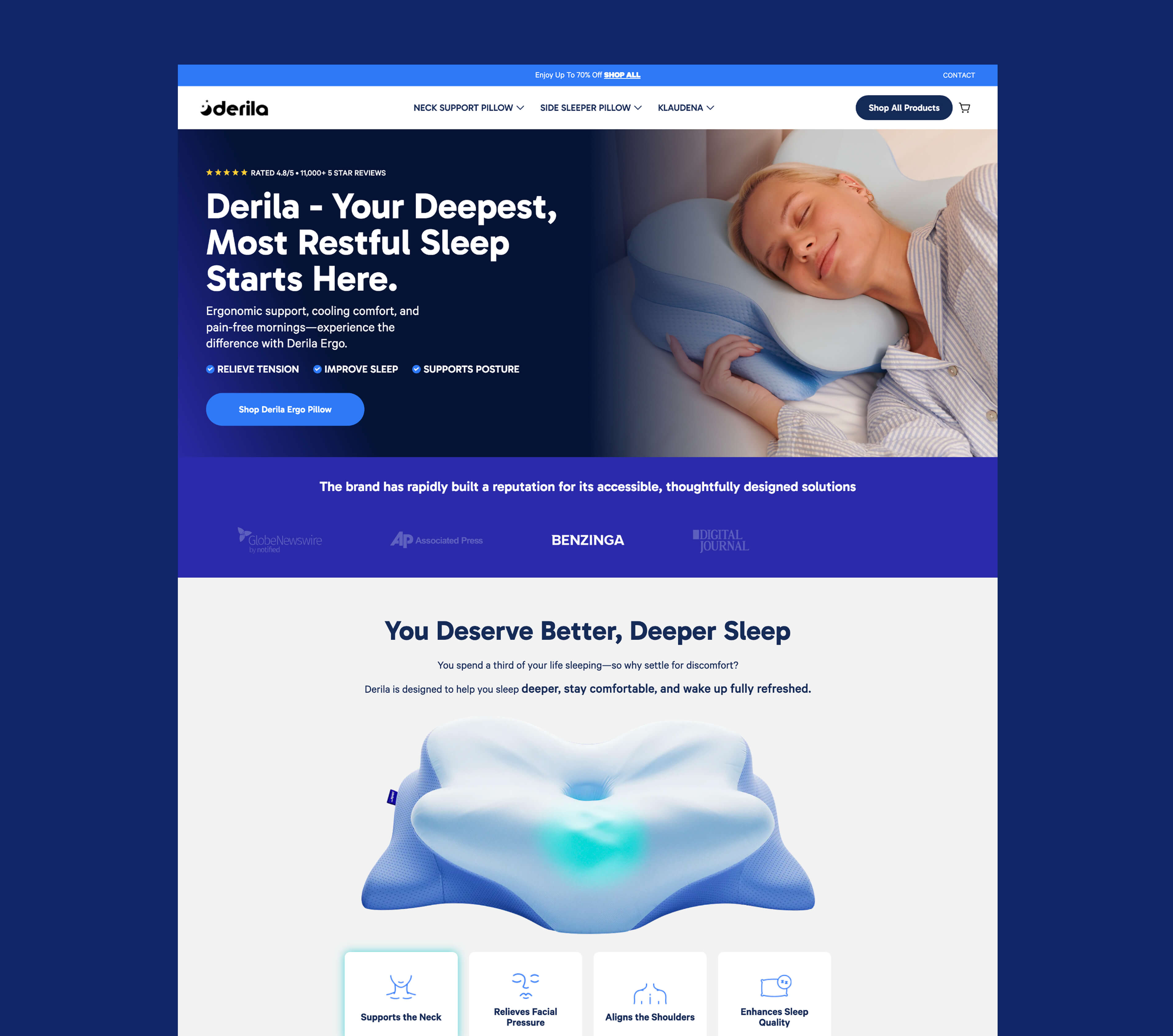

1. Derila (Memory Foam Pillows)

Brand Name & Memorability: 4/10 The name "Derila" is phonetically pleasant and easy to remember, but has no inherent meaning related to sleep or comfort. It's generic enough to work but creates no immediate category association. Moreover it sounds somehow Eastern European, like a flower name or what? That ending with "a" is really strange…

Visual Identity & Consistency: 5/10 Totally basic stuff. For conversions built landingpage.

Positioning Clarity: 4/10 Positioned as "ergonomic memory foam pillow for neck pain," but this positioning is identical to dozens of competitors. No clear differentiation in messaging.

Brand Story/Narrative: 3/10 There's no brand story—just product claims. This absence is strategic: building an authentic brand story requires truth, and truth would reveal the generic sourcing behind the premium positioning. It's easier to have no story than to fabricate one that collapses under scrutiny.

Differentiation: 3/10 Looking at the market, Derila's product and messaging are nearly identical to competitors. The only differentiation is aggressive advertising spend, not brand positioning.

Trust Signals: 4/10 Heavy reliance on Trustpilot reviews (24,500+), but undermined by CHOICE investigation findings and certification verification failures. The sheer volume creates social proof, but quality of signals is questionable.

Logo design: 5/10 Grandma can do this with AI. But that's old logo so no judgement here too much. Flat shape moon and stars from some freepik.com or so is not rocket science. I think it's not worth more to talk about. Period. Visually it's better then that strange name "derila".

Overall Score: 28/70 (42%)

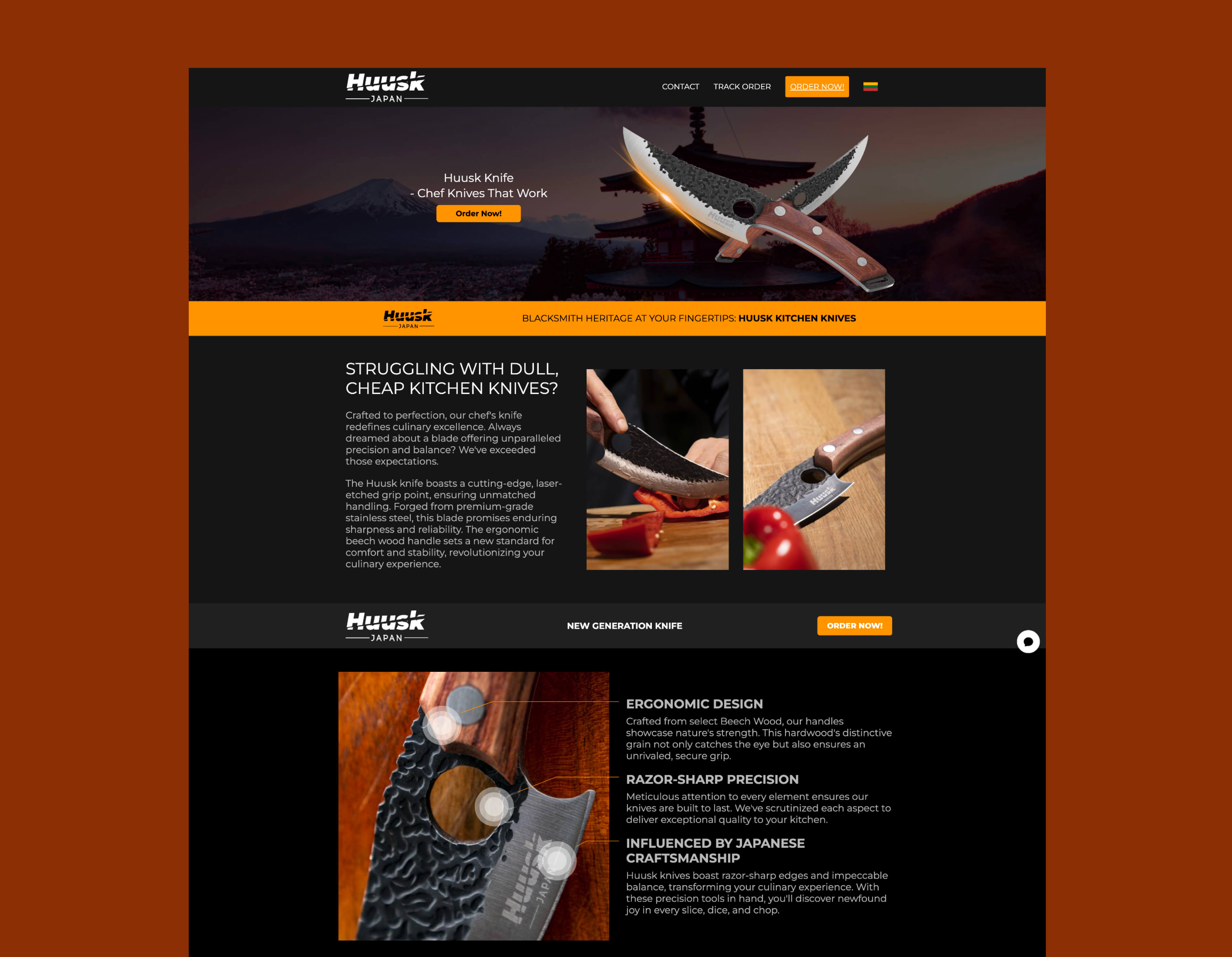

2. Huusk (Kitchen Knives)

Brand Name & Memorability: 7/10 "Huusk" sounds vaguely Japanese/Nordic, which fits the intended positioning. Short, memorable, distinctive. Strong name choice despite the misleading origin story.

Visual Identity & Consistency: 9/10 Surprisingly solid execution, even if dated. The dark background website, moody product photography, and masculine color palette (blacks, metallics, muted tones) all work cohesively. It feels intentionally rugged and tool-focused rather than generic. Yes, the overall aesthetic is basic and feels 3-4 years behind current design trends, but for a knife—even a kitchen knife—this masculine, almost tactical approach makes sense. They've committed to a visual direction and maintained it across touchpoints. The consistency is there, even if the execution isn't cutting-edge.

Positioning Clarity: 2/10 Positioned as "handmade Japanese knives by third-generation bladesmiths" but this is demonstrably false. Once positioning collapses under scrutiny, there's no backup positioning to fall back on.

Brand Story/Narrative: 1/10 No authentic story exists once the Japanese manufacturing claim is debunked.

Differentiation: 3/10 Differentiated in marketing (Japanese craftsmanship) but not in product reality (generic Chinese knives available on AliExpress). Differentiation evaporates upon product receipt.

Trust Signals: 2/10 Two ASA rulings upheld against advertising. Trustpilot added disclaimer about suspected paid reviews. BBB complaints. Fake Website Buster investigations. Every trust signal undermines rather than builds credibility.

Logo Design: 10/10 Genuinely impressive. The logo is excellent—sharp angular letter cuts that feel "knife-like," the Japanese wordmark underneath uses the perfect typeface, even the typically-dated side lines work perfectly in this context. This feels like proper brand design, not just a dropshipping template. They invested in quality visual identity, and it creates a cohesive, masculine, precision-focused aesthetic. Strong work.

Overall Score: 34/70 (50%)

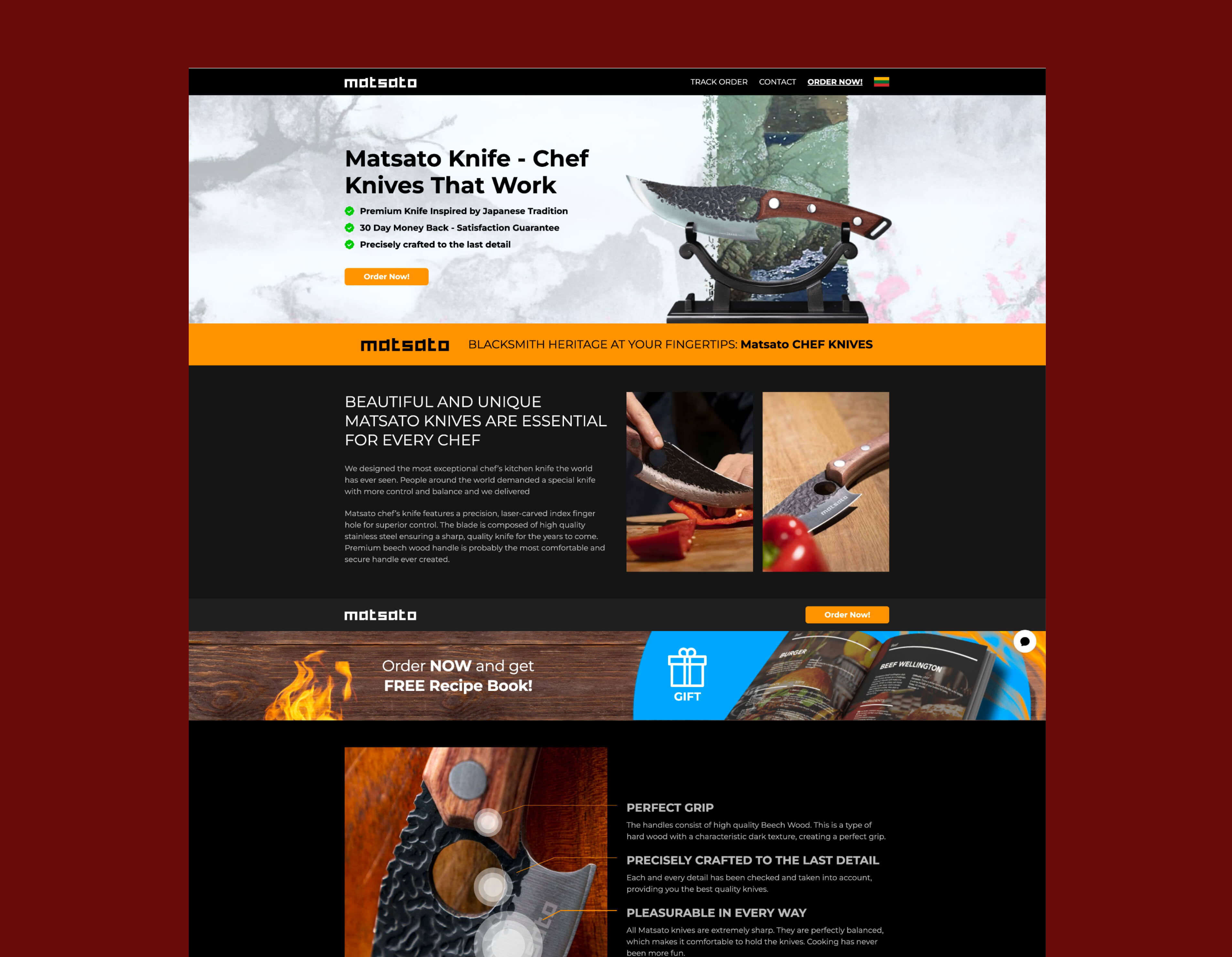

3. Matsato (Kitchen Knives)

Brand Name & Memorability: 6/10 Another Japanese-sounding name following the Huusk playbook. Less distinctive than Huusk (sounds more generic), but serves the same positioning purpose.

Visual Identity & Consistency:5/10 This is essentially Huusk 2.0—same knife, different brand name. The visual identity is nearly identical: dark backgrounds, masculine aesthetic, moody product photography. The only real difference is the hero block background image. This looks like a strategic hedge: Huusk accumulated too much negative feedback and regulatory scrutiny, but the business model works, so why not launch a second brand to keep capitalizing on the same market? It's brand arbitrage, not differentiation. There's zero reason for this brand to exist separately beyond ad account diversification and reputation management.

Positioning Clarity: 2/10 Same false "Japanese craftsmanship" positioning as Huusk. Faces same credibility collapse when investigated.

Brand Story/Narrative: 2/10 No unique brand story. Same stuff.

Differentiation: 2/10 Not differentiated from Huusk (same parent company, same positioning, same product origin). Unclear why both brands need to exist unless it's pure traffic arbitrage across different ad accounts.

Trust Signals: 3/10 Fewer reviews and lower visibility than Huusk, but facing similar credibility issues. ProductReview.com.au shows pattern of complaints about quality versus claims.

Logo Design: 7/10 Standard Japanese-style font with zero distinctive features. After Huusk's genuinely excellent logo design, this feels like a rushed afterthought—slap a Japanese-looking typeface on it and ship. It's not bad enough to hurt conversion, but it's not good enough to build equity. Pure functional placeholder to get the brand live quickly.

Overall Score: 27/70 (35%)

4. Synoshi (Electric Cleaning Scrubber)

Brand Name & Memorability: 5/10 "Synoshi" feels manufactured (which it is) but has no meaning or category association. Not particularly memorable, but not offensive either.

Visual Identity & Consistency: 6/10 The yellow/black color combination works well and differentiates it from their knife brands. However, it's the same website template as Huusk and Matsato—just recolored. This template reuse is clearly a pattern across their entire portfolio: find what converts, replicate the structure, swap the colors. The visual identity is competent enough to make the product feel more innovative than it actually is (it's a generic electric scrubber), but there's no real design thinking here. It's conversion-optimized templating, not brand building.

Positioning Clarity: 6/10 [PLACEHOLDER: Screenshot of main product claim/headline] Positioned as "power scrubber that makes cleaning effortless" - at least this is verifiable and testable. Product does what it claims at a basic level.

Brand Story/Narrative: 4/10 Less reliant on fabricated heritage than knife brands. Story is more "innovative cleaning solution" which is generic but not provably false.

Differentiation: 4/10 Product category (electric scrubbers) is less commoditized than knives/pillows, giving slightly more differentiation. Still faces competition from identical products at lower prices.

Trust Signals: 3/10 Mixed reviews - some positive functionality, many complaints about durability and replacement costs. ScamAdviser rates site 39.4/100. Less regulatory action than other brands but plenty of consumer complaints.

Logo Design: 8/10 Technically well-executed. "Synoshi" has a mystical, Eastern feel, and the dragon head icon integrated into the "O" suggests heritage and craftsmanship. The problem? It's a $5 Temu product. The logo is doing heavy lifting to create perceived value that the product itself doesn't deliver. Good branding can elevate commodity products to a point, but there's a fundamental disconnect here—premium brand identity wrapping a basic electric scrubber. It works for conversion (hence the 7), but it highlights exactly what's wrong with this approach: all the investment goes into the façade, none into the actual product.

Overall Score: 36/70 (50%)

5. Nuubu (Detox Foot Patches)

Brand Name & Memorability: 7/10 "Nuubu" has an Asian wellness feel, which fits the product category. Easy to pronounce, short, memorable enough. Generic but functional.

Visual Identity & Consistency: 4/10 Extremely basic, generic template that feels seriously outdated. The color palette is decent, but in 2025 this looks like a free template you'd find bundled with shared hosting from 2008. Transparent background product images, stock bamboo photography that screams "royalty-free clip art," zero modern design language. It's consistent in its datedness, but that's not a compliment. This visual identity actively undermines the product's credibility—it signals "cheap dropshipping operation" rather than "innovative cleaning solution." They needed to refresh this years ago.

Positioning Clarity: 3/10 Positioned around "Japanese detox tradition" and toxin removal through feet. The entire product category is scientifically questionable, which undermines positioning from the start.

Brand Story/Narrative: 2/10 Claims to be based on "ancient Japanese wisdom" but this is marketing fiction. Detox foot patches have no scientific basis, making any brand story inherently suspect.

Differentiation: 3/10 Differentiated only by brand name in a category full of identical products making identical unverifiable claims. No meaningful differentiation.

Trust Signals: 2/10 Product category itself lacks scientific credibility. Reviews are mixed with many complaints about products not working as advertised and staining issues without actual detox effect.

Logo Design: 8/10 This looks like an older brand from their portfolio—probably one of the first. For 5 years ago, this would've been solid work. Today it feels dated, but not offensively so. The interesting thing: plenty of modern brands designed by "pros" or AI tools actually look worse than this. There's a consistency and restraint here that many newer dropshipping brands lack. It's not current, but it's competent. The fundamentals are there—clear hierarchy, consistent color usage, readable typography. It scores a 7 because execution matters more than being trendy, and this executes its dated aesthetic consistently.

Overall Score: 29/70 (40%)

What the branding analysis reveals

Across all five analyzed brands, the pattern is remarkably consistent: strong brand naming and decent visual execution undermined by weak positioning, fabricated narratives, and eroded trust signals.

The average score across brands is approximately 38-42%, which reflects brands optimized for short-term paid traffic conversion rather than long-term equity building. Every brand shows the same structural weaknesses:

Names are adequate (5-7/10 range) - phonetically pleasant, easy to remember, but lack inherent meaning

Visual identity is functional (5-7/10 estimated) - professional enough for ads, but not distinctive

Positioning collapses under scrutiny (2-4/10) - either provably false (Japanese knives) or generic (pillow for neck pain)

Brand stories are fabricated or nonexistent (1-4/10) - no authentic narrative survives investigation

Differentiation is minimal (2-4/10) - separated only by marketing spend, not product or positioning

Trust signals actively undermine brands (2-4/10) - regulatory actions, fake review disclaimers, consumer complaints

Cohesion is maintained (5-7/10 estimated) - they execute consistently within each brand, even if foundation is weak

This is textbook optimization for the wrong metric. These brands convert paid traffic effectively (proven by €153M revenue) but build zero equity. The moment advertising stops, brand value is zero.

The checkout experience generates consistent complaints

Across all Orbio brands, the single most documented complaint is checkout systems that automatically increase order quantities. The pattern appears systematic:

Derila: CHOICE confirmed ordering 1 pillow resulted in 4 pre-selected at checkout

Synoshi: Customers report ordering 1 scrubber and receiving charges for 4 units

Huusk: Reviews describe orders "sneakily defaulting" from 1 to 4 items

The checkout flow prevents backwards navigation to review orders. PayPal orders process immediately through autopay without customer verification of final quantities. This isn't a bug—it's a conversion optimization technique that increases average order value at the cost of customer trust.

Additional friction points include:

Returns requiring international shipping to Lithuania regardless of where products shipped from (often costing $75-100 for Australian customers)

15% restocking fees after 14 days

RMA approval required before return shipping

Escalating discount offers (15%, then 30%) to prevent returns

The return policy isn't designed to satisfy dissatisfied customers—it's designed to make refunds economically irrational.

A side note: While writing this article, I tested several of their brand checkouts myself. In all cases, the default selection was a single product—nothing was sneakily added to increase the quantity to 2, 3, or 4 items. It's worth acknowledging that consumers sometimes blame sellers for their own user errors or moments of inattention.

What proper brand strategy looks like in white-label

Here's where Orbio World's story becomes instructive for anyone building in this space—and where understanding the difference between marketing execution and brand strategy becomes critical.

Orbio World didn't fail at marketing. They're exceptionally good at it. They failed at building brands with equity. There's a profound difference, and it determines whether you're building an asset or just running a treadmill.

The disposable brand trap

Look at Orbio's portfolio strategy: 22+ separate brands, each operating as an independent marketing funnel. Derila for pillows. Huusk for knives. Synoshi for scrubbers. Each brand exists solely to convert ad traffic into purchases for a single product or tight product line.

This approach has one massive advantage: laser-focused messaging. Every ad, every landing page, every piece of copy speaks directly to one problem with one solution. The conversion optimization is clean. You can test relentlessly without diluting brand messaging.

But here's what they sacrificed:

Zero cumulative brand equity. Every brand starts from scratch. Every brand requires independent advertising to generate awareness. Every brand needs its own social proof, review accumulation, and trust-building. When you launch brand #23, you have zero advantage from brands #1-22. The work never compounds.

Complete advertising dependency. Stop running ads to Derila, and Derila revenue stops. There's no organic search traffic because "Derila" means nothing to anyone who hasn't seen an ad. There's no word-of-mouth because customers don't identify with the brand. There's no repeat purchase behavior because the brand doesn't represent anything beyond "that pillow I bought from an ad."

Unsellable assets. What's the exit value of a brand that generates zero revenue without continuous ad spend? These aren't businesses—they're arbitrage mechanisms. The moment advertising costs increase or platform algorithms change, the entire model breaks.

The alternative: building brands with positioning

The counterintuitive reality in white-label: when your products are commodity, your brand needs to be STRONGER, not weaker.

Real brand strategy in white-label doesn't mean doing less marketing—it means making strategic decisions that create equity that compounds over time:

1. Authentic positioning instead of fabricated heritage

Orbio's "Japanese knives made by third-generation bladesmiths" collapsed under scrutiny because it was fiction. The moment anyone investigated, the entire positioning crumbled.

The strategic alternative: Own what you actually are.

"Premium kitchen tools at fair prices by cutting out middlemen" - True, defensible, actually compelling to price-conscious consumers.

"Professional-grade home goods curated for serious home cooks" - Positions you as the expert curator, not the manufacturer.

"Direct-from-factory cookware that delivers restaurant quality without restaurant markups" - Transparent about sourcing, compelling on value.

Each of these creates positioning that can sustain scrutiny. You can build marketing campaigns around them. You can create content around them. You can attract customers who identify with the positioning, not just the product.

2. Visual identity that builds trust across products

Here's where having fewer brands with stronger identity becomes powerful.

Instead of 22 separate visual identities that each start from zero, imagine building 2-3 brands with such strong visual identity that customers recognize your products before reading the brand name:

Distinctive product photography - Not the standard white-background Amazon style everyone uses. Create a signature look that signals quality and attention to detail.

Consistent packaging experience - When customers receive products, the unboxing reinforces brand memory. They remember you. They tell friends. They post on social media with your brand visible.

Cohesive digital presence - Website, email, social media, ads—everything speaks the same visual language. Customers see your ad after receiving a product and think "that's the brand I bought from" instead of "that looks familiar but I'm not sure."

This compounds. Customer #1000 is easier to acquire than customer #1 because your brand exists in the collective consciousness. People have seen your Instagram. They've seen your packaging in unboxing videos. They've read reviews mentioning your brand by name.

3. Category authority instead of single-product focus

The Orbio model: One brand = one product. Derila only makes sense as a pillow brand. Huusk only makes sense for knives. If the product trend fades, the brand dies.

The strategic alternative: Build brands around categories or customer segments.

Instead of "Derila - The Memory Foam Pillow Brand," build "Derila - Sleep Essentials for People Who Care About Rest." Now you can sell:

Premium pillows (multiple types, not just one)

Weighted blankets

Blackout curtains

White noise machines

Sleep tracking accessories

The brand benefits from each product launch. Pillow customers discover weighted blankets. Weighted blanket customers buy pillows. The lifetime value increases. The brand becomes associated with an entire category, not a single product.

Or instead of "Huusk - Japanese Knives," build "Heritage Kitchen - Professional Tools for Home Cooks." Now you're:

Curating multiple knife styles

Adding cutting boards, sharpening tools

Expanding to other kitchen essentials

Creating recipes and technique content

Building a community of serious home cooks

You're no longer dependent on one product staying trendy. You're building authority in a category.

4. Customer experience as brand differentiation

When everyone can source the same products from the same factories, customer experience becomes the only real differentiator.

Orbio's approach: Maximize short-term conversion with dark patterns (pre-selected multiple items, fake urgency, difficult returns). It works for acquisition but destroys lifetime value and brand reputation.

The strategic approach: Make customer experience so good it becomes your marketing.

Transparent pricing - No fake "70% off" that runs every day. Just fair pricing clearly explained.

Simple returns - Not "ship to Lithuania at your cost" but "free returns, full refund, no questions." Yes, it costs more. It also builds trust that creates repeat purchases.

Responsive service - Not Philippines call centers reading scripts but actual support that solves problems.

Educational content - Knife sharpening tutorials. Sleep optimization guides. Recipe videos. Content that makes customers better at using your products.

This creates word-of-mouth. People tell friends "I bought from Brand X and the experience was amazing." They become repeat customers because they trust you. They don't comparison shop on price because they're buying the relationship, not just the product.

The financial transformation

This isn't just about building something you're proud of—it's about fundamentally different unit economics.

Orbio's model:

1.3% net margins

€50-100M annual ad spend to maintain €153M revenue

Customer acquisition cost as % of AOV: ~70-80%

Repeat purchase rate: Minimal (disposable brands create no loyalty)

Exit value: Liquidation only (no brand equity to sell)

Brand equity model:

20-35% net margins (higher prices justified by positioning)

€10-30M annual ad spend for same revenue (50-70% from repeat/referral)

Customer acquisition cost as % of AOV: 30-40% (drops over time as brand grows)

Repeat purchase rate: 40-60% (customers identify with brand)

Exit value: 3-5x revenue multiples (buying brand equity, not just funnels)

The math completely changes. Instead of needing to spend €100M to generate €153M (a treadmill), you might spend €30M to generate €150M (an asset that compounds).

Strategic brand decisions for white-label operations

If you're building a white-label operation, these are the strategic questions that determine whether you're building equity or just running arbitrage:

How many brands, and why? Not "as many as possible" and not "exactly one." The question is: What's the strategic reason for each brand? If you can't articulate why this brand needs to exist separately (different customer segment, different category, different positioning), it shouldn't.

Three focused brands with clear positioning beats twenty-two disposable funnels.

What's the positioning based on? If your answer is "we say it's premium/Japanese/doctor-recommended," you're building on sand. If your answer is "we're the only brand that [specific thing customers can verify]," you have a foundation.

What's your visual identity strategy? Are you creating distinctive assets that compound in value as more people see them? Or using generic templates that could belong to any brand? Your visual identity should make you recognizable before customers read your name.

What's your customer experience philosophy?

Are you optimizing for maximum short-term conversion with friction everywhere? Or investing in experience that creates lifetime value? The answer determines whether you're in the transaction business or the relationship business.

What content are you creating beyond ads? If your only content is direct-response ads, you're not building a brand. Real brands create content that attracts, educates, and builds community. That content becomes your moat.

Why this matters more as you scale

At €10K/month revenue, brand strategy might feel like a luxury. You need sales now, and direct-response ads deliver them.

At €100K/month, the cracks start showing. Customer acquisition costs rise. You're spending more to generate the same revenue. There's no compounding—just linear scaling that requires linear ad spend increases.

At €1M/month+, without brand equity you're trapped. You can't reduce ad spend without revenue collapse. You can't raise prices because you have no positioning to justify them. You can't exit because you've built a machine that only works while you're feeding it money.

Orbio World at €153M revenue proves this. They succeeded wildly at marketing arbitrage. They failed completely at building brand equity. The result: 1.3% margins, regulatory actions in three countries, thousands of complaints, and zero exit value despite massive revenue.

The question for anyone building in white-label: Are you building marketing funnels or building brands? The answer determines whether you're creating wealth or just generating revenue.

The case study's real lesson

Orbio World proves that performance marketing at scale absolutely works. You can build €153M revenue with commodity products and sophisticated advertising.

They also prove the limitations of that model. Twenty-two brands with zero equity. Regulatory actions in three countries. Thousands of complaints about checkout manipulation. Complete dependency on advertising algorithms. No path to building something with lasting value.

For entrepreneurs considering white-label dropshipping, the question isn't "Can this work?" Orbio World proved it can. The question is: What are you trying to build?

A marketing arbitrage operation that generates revenue but builds nothing? The playbook is sitting right there, documented in detail.

Or brands with equity, loyalty, and defensible positioning that compound value over time? That requires different strategic decisions from day one—particularly around brand strategy, product curation, and customer experience.

The strategic branding decisions you make at the beginning determine everything that follows. The difference between building €153M in revenue with 1.3% margins and building €150M in revenue with 30% margins isn't execution—it's strategy.

Want the complete framework? Download The €5K to €150M White-Label Dropshipping Playbook—the full execution guide including supplier sourcing, performance marketing strategies, unit economics, team building, and the brand strategy decisions that determine whether you're building equity or just generating revenue.

Download the Complete Playbook → (Coming soon)